Block Advisors helps small business owners leverage the tax benefits of stimulus aid and other pandemic-related business impacts

KANSAS CITY, Mo., March 19, 2021 (GLOBE NEWSWIRE) -- The American Rescue Plan includes a third wave of stimulus relief for small businesses, extending or expanding many of the same programs from previous bills, including the Payroll Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). Yet, many small business owners still don’t understand the complex nuances of what’s available or how stimulus aid impacts their small business taxes. Block Advisors can help them make sense of the new plan and take advantage of its tax benefits, assuming the task of tax filing so small business owners can focus on the business they love.

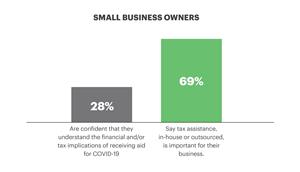

Block Advisors, a team within H&R Block, has been studying the effects of the pandemic on small businesses in its ongoing “Small Business Recovery Series” study. The most recent data reveals that only 28% of small business owners are confident that they understand the financial and/or tax implications of receiving aid for COVID-19. Additionally, seven in 10 (69%) say tax assistance, in-house or outsourced, is important for their business.

“Small business owners have had an incredibly tough year. Of those still in business, many have had to pivot their business models just to survive. And those pivots can have their own tax implications,” said Ian Hardman, vice president and GM of small business at H&R Block. “After all they’ve been through, small business owners shouldn’t also have to worry about complicated stimulus and COVID-related tax issues. The Block Advisors small business certified tax pros can take that burden off their shoulders.”

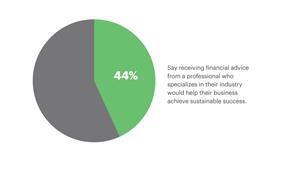

The same study also revealed that 44% of small business owners say receiving financial advice from a professional who specializes in their industry would help their business achieve sustainable success.

“That’s what Block Advisors does ̶ we help our small business clients not only survive but thrive and achieve long-term success. No one should have to navigate the financial challenges of the past year alone, and they don’t have to. Block Advisors is here to help small business owners unravel the complicated tax issues from 2020, while also putting a financial lens on their business, guiding them to better long-term outcomes,” said Hardman.

For more information about stimulus relief and benefits for small businesses from the American Rescue Plan Act of 2021 visit the Block Advisors’ guide to 2020 small business taxes and stimulus relief,

Block Advisors, a team within H&R Block, is dedicated to meeting the tax, bookkeeping and payroll needs of small business owners year-round. To start working with the tax experts at Block Advisors, visit blockadvisors.com.

H&R Block conducted the third wave of a 10-minute online study among a sample of n=2.875 of its clients who qualified as small business owners, here defined as majority owners of businesses with fewer than 50 employees. The margin of error for this sample is +/- 2% at the 95% confidence level. The survey was fielded between January 14 and January 26, 2021. The previous wave was fielded between September 2 and September 26, 2020.

About H&R Block

H&R Block, Inc. (NYSE: HRB) provides help and inspires confidence in its clients and communities everywhere through global tax preparation, financial products, and small business solutions. The company blends digital innovation with the human expertise and care of its associates and franchisees as it helps people get the best outcome at tax time, and better manage and access their money year-round. Through Block Advisors and Wave, the company helps small business owners thrive with innovative products like Wave Money, a small business banking and bookkeeping solution, and the only business bank account to manage bookkeeping automatically. For more information, visit H&R Block News or follow @HRBlockNews on Twitter.

For further information

Investor Relations: Colby Brown | 816-854-4559 | colby.brown@hrblock.com

Media Relations: Angela Davied | 816-854-5798 | angela.davied@hrblock.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/47f542db-3d2a-45b1-874a-5d77f408ce14

https://www.globenewswire.com/NewsRoom/AttachmentNg/e49a6f5c-9582-4f2b-ba67-c31336a88b6d

Small business owners say tax assistance is important

Seven in 10 (69%) small business owners say tax assistance, in-house or outsourced, is important for their business.

Small business owners on receiving financial advice

44% of small business owners say receiving financial advice from a professional who specializes in their industry would help their business achieve sustainable success.

Source: HRB Tax Group, Inc.