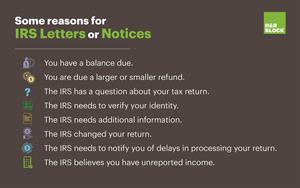

IRS letters trigger anxieties on cryptocurrency, estimated payments and much more

KANSAS CITY, Mo.,

| ||||||||||

“Some of these notices are really just a courtesy, meant to help taxpayers understand their obligations and stay ahead of the curve. But that doesn’t relieve the taxpayer of the stress and anxiety that receiving an IRS letter can cause. It’s nerve-racking. Plus, some letters do require a response or some action from the taxpayer,” said Andy Phillips, director at

An experienced

The client starts with a free diagnostic analysis to identify the tax issue, and a tax professional will explain the resolution process. The expert works to resolve the issue with the taxing authority, whether that is the IRS or a state department of revenue. The expert follows up with the client and explains the results and next steps to remain compliant. The client is charged a flat, upfront fee based on the complexity of their tax situation. This eliminates the surprise of hidden fees and price hikes as the issue is being addressed.

“H&R Block cuts through the confusion of receiving an IRS letter, with a free evaluation, and plan to fix it. We’ll put the plan into action until your problem is solved,” said Phillips.

In addition, clients can get help that fits their busy lifestyle. They can get started by visiting an office or calling, then simply uploading their letter and getting matched with a skilled tax professional who will give them a free quote. The client can choose the most convenient method to receive help: over the phone or in person.

To get started, call 1-855-536-6504 or make an appointment.

About H&R Block

Photos accompanying this announcement are available:

https://www.globenewswire.com/NewsRoom/AttachmentNg/99840212-c4c5-4273-a13f-2a585dabe7fe

https://www.globenewswire.com/NewsRoom/AttachmentNg/5a6510dc-110c-44d3-b64c-3220400802f4

For Further Information Investor Relations: Colby Brown ǀ (816) 854-4559 ǀ colby.brown@hrblock.com Media Relations: Susan Waldron ǀ (816) 854-5522 ǀ susan.waldron@hrblock.com

Source: HRB Tax Group, Inc.